Little Known Questions About Gold Card Visa.

How Gold Card Visa can Save You Time, Stress, and Money.

Table of ContentsThe Ultimate Guide To Gold Card VisaThe 10-Minute Rule for Gold Card VisaThe Definitive Guide for Gold Card VisaThe Single Strategy To Use For Gold Card VisaNot known Details About Gold Card Visa Gold Card Visa for BeginnersNot known Details About Gold Card Visa

Such a guideline would certainly likewise be a separation from the existing united state federal tax legislations which enforces a globally income tax on united state people and locals. Hence, the program can draw in foreign individuals who may otherwise stay clear of the USA as a result of its aggressive tax obligation reach. This brand-new action synchronized with another major modification in immigration policy.The announcement targets petitioners making use of the H1-B program for specialized line of work employees. The announcement includes that the restriction will certainly expire in 12 months if the Head of state chooses not to extend it.

At the same time, the new H-1B restrictions underscore the Administration's readiness to reshape standard employment-based immigration categories with economic barriers. Stakeholders ought to carefully monitor forthcoming firm advice, examine tax implications, and plan for both the chances and obstacles these policies existing as extra information appears. Positive preparation will be necessary as the landscape of U.S

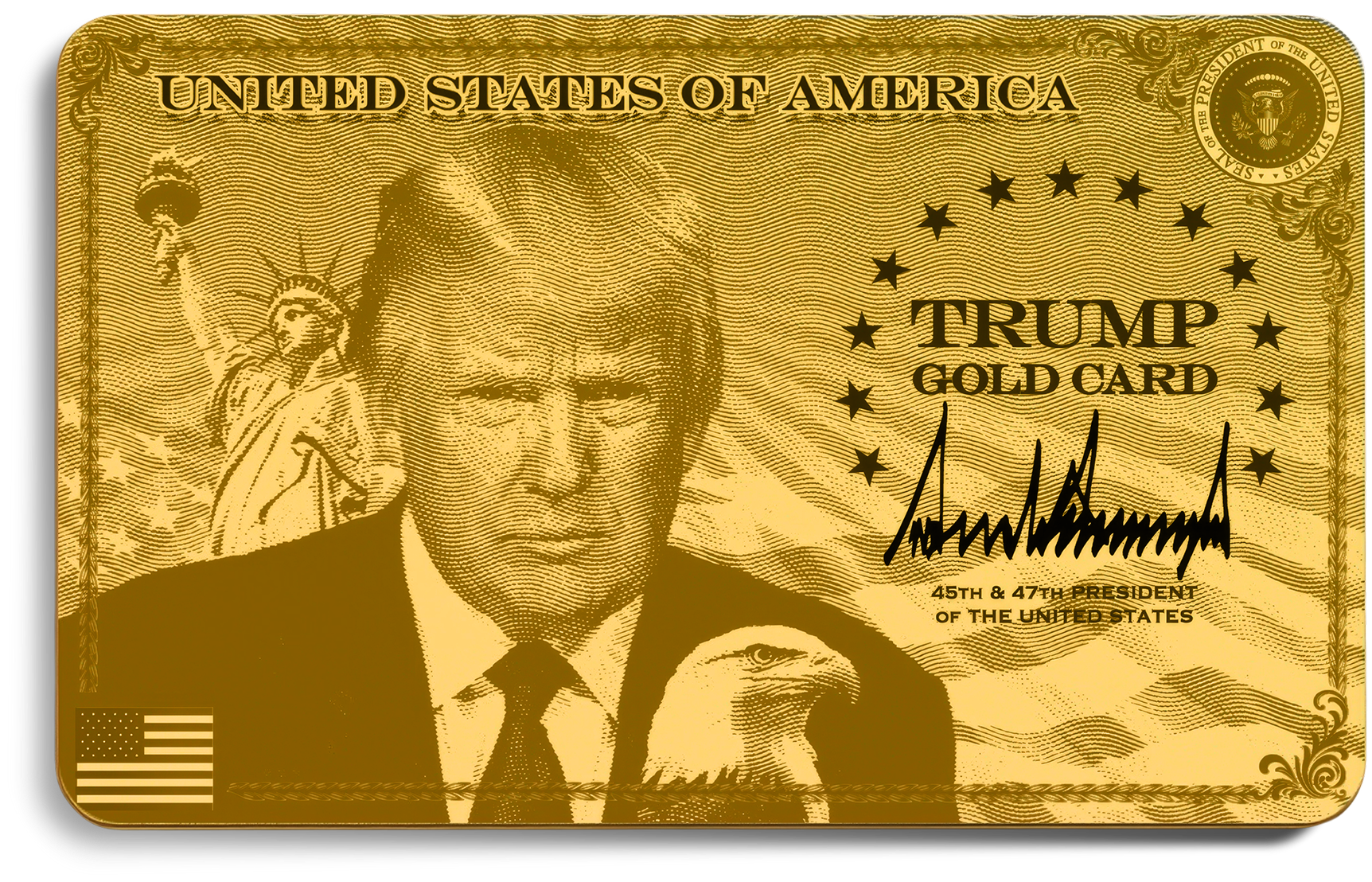

The "Gold Card": Examining the current Immigration Advancement In public comments on Tuesday February 26th, Head of state Trump discussed a proposal for a new sort of united state visa, a "Gold Card". While the President did not go into information, he recommended that this new visa can be provided to firms or to people for $5 million per card.

Gold Card Visa Can Be Fun For Anyone

There is a substantial tax advantage attached to this Gold Card proposition. To bring in future Gold Card holders, the management states the United state will not tax them on their around the world income, however just on their U.S. income. It is vague if the idea is for this advantage to proceed if they select to come to be United state residents or is just readily available to those who stay in Gold Card condition.

The 45-Second Trick For Gold Card Visa

For the US Gold Card to become a legislation, the proposal should pass your home of Representatives and the Us senate to secure bipartisan support, which can be tough provided its controversial nature. Additionally, firms like the US Citizenship and Immigration Solutions (USCIS) and the US Division of Homeland Safety (DHS) will need to attend to concerns pertaining to nationwide safety and security, identification checks, money laundering, and the moral implications of the Gold Card visa owner.

United States Embassy and Consulates had actually issued a lot more than one million non-immigrant visas, a virtually 26 percent rise from 2023. This growth in worldwide interaction could create an encouraging atmosphere for the US Gold Card visa in the future.

Significantly, as we will certainly talk about later, it legal modifications to carry out a Gold Card visa have actually been left off the most recent budget plan proposals. Under this "plan", the Gold Card program would approve permanent residency in exchange for a minimal $5 million investment. Subsequent declarations from the administration have actually recommended that the EB-5 and Gold Card programs may exist side-by-side in some capability, possibly under the oversight of the Division of Commerce.

The 9-Second Trick For Gold Card Visa

The Head of state can not single-handedly remove the EB-5 programthis calls for an act of Congress. The EB-5 program was originally created in 1990 and later strengthened by the RIA in 2022. Considering that it is ordered in the Migration and Citizenship Act (INA), any type of initiative to rescind or change the program would certainly need the flow of brand-new regulation via both chambers of Congress.

This is because of the fact that, unlike various other immigration expenses that were not permitted to go through the budget costs process as changes, the intent behind the Gold Card is to straight lower the deficiency. Gold Card Visa. As of this short article, no mention of the Gold Card or similar programs can be found in the House or Senate proposals for the present spending plan.

Provided the intricacy of this procedure, any kind of adjustments to the EB-5 program would likely take months and even years to emerge. Historically, immigration-related legislative changes have actually encountered significant obstacles, calling for bipartisan support, financial reason, and legal scrutiny. Furthermore, previous efforts to present substantial overhauls to the EB-5 programsuch as increasing investment limits or tightening up regional facility regulationshave taken years to pass.

Under the EB-5 Reform and Honesty Act (RIA), the EB-5 Regional Center (RC) program is licensed with September 30, 2027. This implies that unless Congress rescinds, customizes, or replaces the program, it will stay effectively till that date. Better, Congress has especially suggested financial investment amounts for EB-5 and that can not be transformed by exec order or policy.

What Does Gold Card Visa Do?

If the great post to read Gold Card visa requires a $5 million financial investment yet does not provide the exact same versatility in work production criteria, it may adversely impact investment flow into specific sectors, possibly limiting chances for middle-market capitalists. Among the biggest arguments for keeping the EB-5 visa is its tried and tested record in promoting the U.S.

By setting the minimum financial investment threshold at $5 million, the U (Gold Card Visa).S. government might be: Targeting ultra-high-net-worth capitalists Intending for bigger facilities investments Creating a streamlined pathway for global magnate However, increasing the investment quantity could likewise evaluate many prospective investors, especially those from emerging markets who may battle to meet such a high economic limit

Getting My Gold Card copyright Work

His litigation initiatives were instrumental in Shergill, et al. v. Mayorkas, a spots situation that brought about the U.S - Gold Card Visa. government identifying that under the INA, L-2 and E visa spouses are accredited to work incident to their condition, removing the demand for separate EAD applications. This case has changed work permission for hundreds of families across the United States

By the authority vested in me as President by the Constitution and the regulations of the United States of America, it is hereby purchased: Area 1. Purpose. My Administration has actually functioned non-stop to reverse the disastrous migration policies of the prior administration. Those plans produced a deluge of immigrants, without serious consideration of how those immigrants would impact America's interests.

The Gold Card. (a) The Secretary of Business, in sychronisation with the Assistant of State and the Assistant of Homeland Safety and security, will establish a "Gold Card" program licensing an alien who makes an unrestricted present to the Division of Commerce under 15 U.S.C. 1522 (or for whom a company or comparable entity makes such a gift) to establish qualification for an immigrant visa utilizing an expedited process, to the degree consistent with regulation and public safety and security and national protection concerns.

(b) In settling visa applications, the Assistant of State and the Assistant of Homeland Protection shall, constant with appropriate law, treat the present defined in subsection (a) of this area as proof of eligibility under 8 U.S.C. 1153(b)( 1 )(A), of outstanding service ability and nationwide benefit under 8 U.S.C. 1153(b)( 2 )(A), this link and of eligibility for a national-interest waiver under 8 U.S.C.

The Definitive Guide to Gold Card Visa

(c) The Assistant of Commerce will transfer the presents added under subsection (a) of this section in a different fund in the Division of the Treasury and use them to advertise commerce and American industry, regular with the statutory authorities of the Division of Commerce, see, e.g., 15 U.S.C. 1512.